The Inflation Reduction Act (IRA) introduced and expanded tax credits for clean energy technologies including game-changing new provisions that enable tax-exempt and governmental entities—such as states, local governments, Tribes, territories, and nonprofits—to take an active role in building the clean energy economy.

The IRA also invested billions of dollars in rebate programs aimed at providing low- and middle-income households point-of-sale discounts on high-efficiency home appliances and equipment and reducing the upfront cost for all households that take whole-home measures to increase energy efficiency. The Alaska Housing Finance Corporation is currently developing these programs to be implemented across the state.

And the USDA’s Rural Energy for America Program (REAP) provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make energy efficiency improvements. Agricultural producers may also apply for new energy efficient equipment and new system loans for agricultural production and processing.

Individuals interested in taking advantage of the federal funding available to them have a few options. The panelists from the White House and U.S. Department of Treasury recommended that Alaskan homeowners check out the IRA Taxpayer Resource Hub and the Energy Savings Hub webpage to learn and stay informed on what clean energy projects can be reimbursed through the federal tax credits available now through the Inflation Reduction Act.

The Energy Savings Hub webpage outlines the two-dozen different clean energy tax credits available to homeowners, including some tax credits available to renters. From making home energy efficiency upgrades, like upgrading air conditioners, to making clean energy investments, like purchasing electric vehicles and charging infrastructure, the webpage outlines in detail what clean energy projects are eligible for tax credits and how individuals can claim their tax credits with an IRS Form 5695 when filing taxes. The webpage also includes energy saving tips for households to reduce their energy bills and a tool that allows users to compare the cost of driving an electric vehicle (BEV) or a plug-in hybrid electric vehicle (PHEV) to a conventional vehicle. The IRS also has a two-page document detailing the clean energy tax incentives for individuals and more information on the annual Residential Clean Energy Credit (25D).

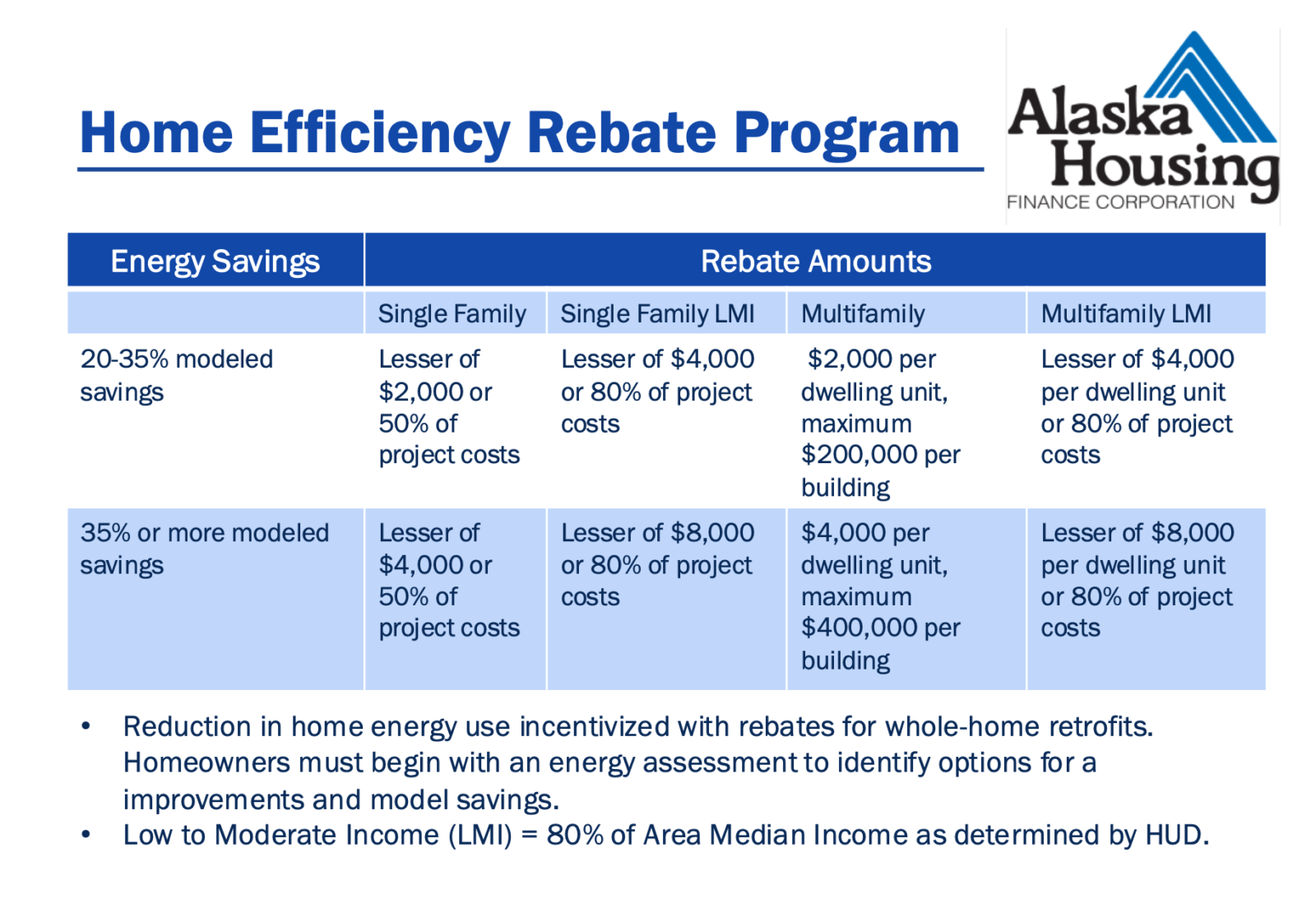

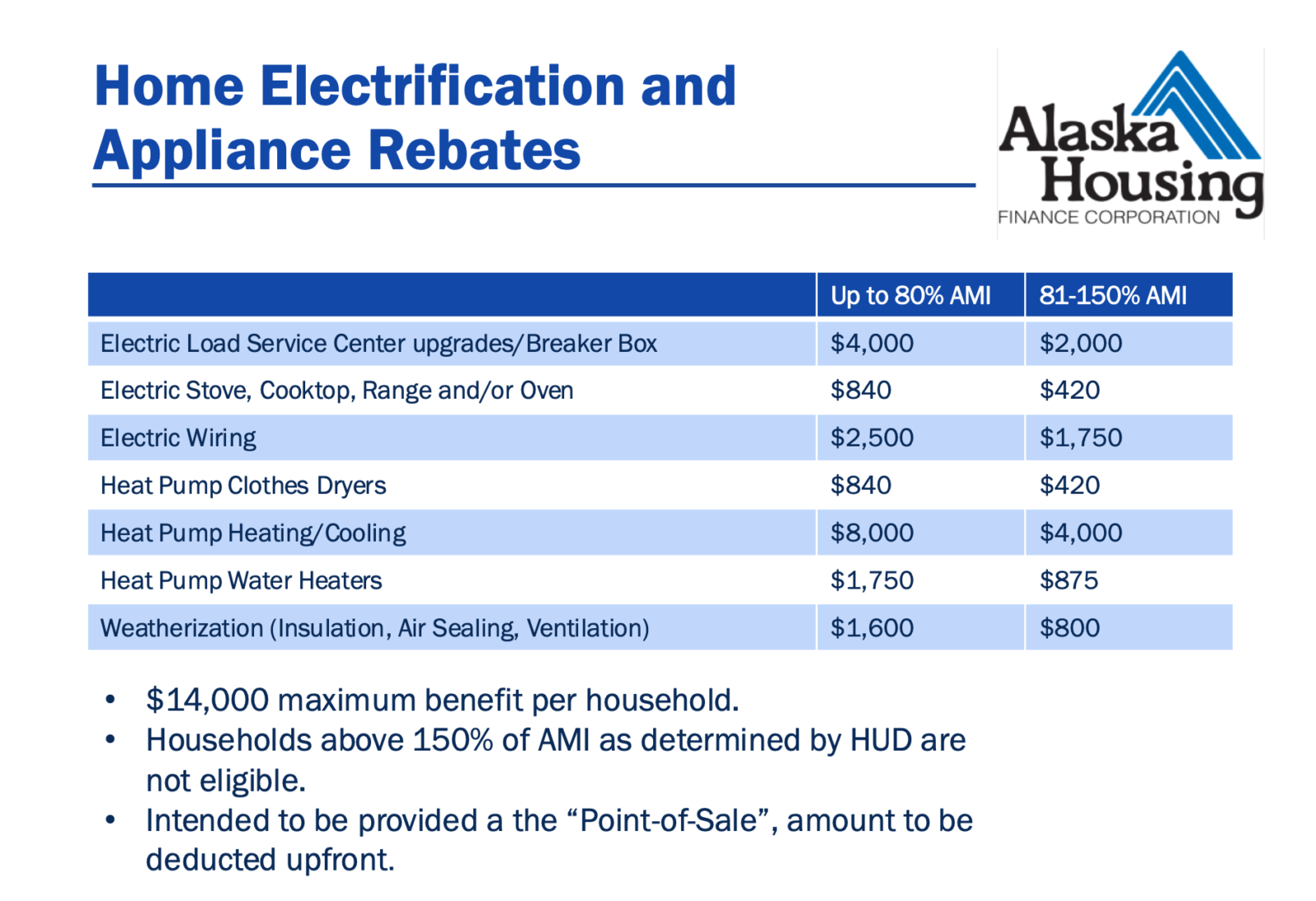

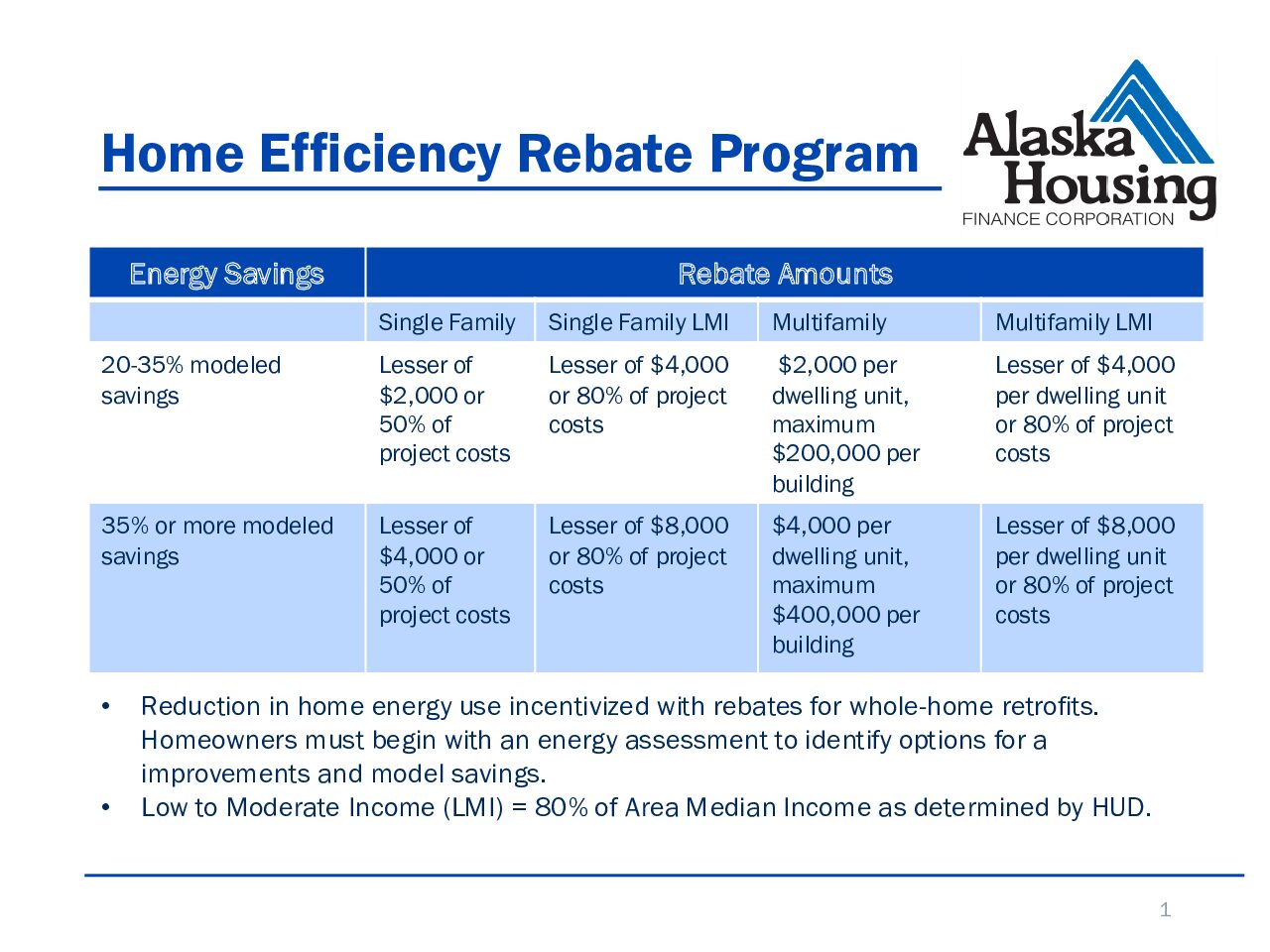

States are also administering their own rebate programs for household clean energy projects and investments. Alaska is currently working on its application for home efficiency and home electrification and appliance programs to be administered through the AHFC. The home efficiency rebate program will be similar to the Home Energy Rebate Program that ran from 2008-2018 in Alaska, and participation in the old rebate program does not exclude participation in the upcoming program. The incoming rebate program will provide homeowners with an energy assessment and rating to identify options for home improvements. After choosing the upgrades they would like to make for their homes, homeowners receive a post energy rating and a rebate for their projects based on their modeled savings from their energy assessment. AHFC has an approved Energy Rater/Inspector List for homeowners to consult for their home efficiency projects and purchases. The home electrification and appliance rebate program provides point-of-sale rebates for specific electric and appliance upgrades for existing and new homeowners.

Both the home efficiency and home electrification and appliance rebate programs are geared towards providing greater incentives for low to moderate income households to make clean energy home upgrades. The AHFC is currently working with the Department of Energy (DOE) to make their programs as accessible as possible, with the hope for rebates up to 100% of project costs available to lower income households for the home efficiency rebate program. Households can access income limit information from the 2024 fiscal year to determine their eligibility for rebates. There will be an AHFC energy rebate stand-alone site, but it is not quite ready for launch. Learn more about the upcoming programs and sign up for updates on the Alaska Residential Energy Rebates page on the AHFC website.

Organizations, agricultural producers, and rural small businesses also have multiple opportunities to take advantage of federal funding. Individuals unsure about their eligibility for clean energy tax credits can find out how the IRA can help them through the U.S. Department of Treasury’s IRA Landing Page.

Tax-exempt organizations under the 501c(3) portion of the tax code, including non-profits, churches, schools, labor unions, rural co-operatives, and governmental entities, that would otherwise be unable to claim certain credits because they do not owe federal income tax are now eligible to receive clean energy tax credits through a new mechanism called elective pay, also known as direct pay. The IRS has a list of clean energy tax credits eligible through elective pay and more information on elective pay and transferability, which allows entities that can’t use elective pay but do qualify for an eligible tax credit to transfer all or a portion of the credit to a third-party buyer in exchange for cash. To be eligible to make the election on a tax return, entities must register with the IRS before filing their taxes. Registration numbers must be included on the entity’s tax return for an elective payment or transfer election to be effective. There is still time for tax-exempt institutions to earn credits for their clean energy investments made in the 2023 tax year, with the deadline to file on November 15. For those interested, the IRS is hosting office hours to assist with the pre-filing registration process for elective payment and transfer of clean energy and CHIPS credits.

Agricultural producers and rural small businesses have the opportunity to receive funding for energy efficiency and renewable energy projects through USDA’s REAP program. Agricultural producers with at least 50 percent of their gross income coming from agricultural operations are eligible to apply for a USDA REAP loan or grant. USDA’s REAP grants can be used to cover up to 50% of the total eligible project cost, with a cap of $1,000,000 in grant funds for renewable energy projects and $500,000 for energy efficiency projects. Some past successful USDA REAP-funded projects in Alaska include a power line connecting a sawmill to an existing hydroelectric project in Southeast Alaska and rooftop solar installations on a variety of small businesses in Fairbanks. Rural small businesses and agricultural producers in Alaska looking to apply for funding through USDA REAP can request to receive technical assistance and support. Visit the USDA REAP webpage for more information on the USDA REAP grants and loans for agricultural producers and rural small businesses.

Time and time again, the webinar underscored the myriad opportunities available for Alaskan homes and businesses to take advantage of clean energy funding, along with the wealth of resources to help individuals and institutions understand and access these opportunities. REAP wants to emphasize that this information is not meant to serve as tax advice. Folks who are looking for that sort of advice can access IRA-related tax guidance from the U.S. Department of Treasury here. Our aim is to arm Alaskan individuals and institutions with the information that can empower them to plan their clean energy investments and harness the wealth of funding opportunities available to them.

The panelists also emphasized that with such a wealth of opportunities available to individuals and institutions for clean energy investments, there is likely an opportunity for all Alaskans to play a role in the clean energy economy.

Additionally, opportunities like the clean energy tax credits are not competitive, meaning that all eligible individuals who successfully apply will receive the credit. The tax credits are also mostly uncapped at the individual and national level until 2032, meaning that individuals and institutions have the opportunity to plan for and think big about their clean energy investments. Clean energy tax credits can also generally be stacked with federal and local grants, like the USDA REAP energy efficiency and renewable energy project grants, for example.

And the panelists reassured attendees that they are just in time to be joining these conversations and learning more about what funding is available to them. They share REAP’s hope that webinars like serve to ignite conversations between these funding agencies and individuals and institutions looking to take advantage of their clean energy funding opportunities.

Each of the panelists graciously offered to answer any questions folks have as they consider what clean energy investments make the most sense for them. Please feel free to reach out to REAP’s ANEEE Program Manager, Jenny Starrs, at jstarrs@realaska.org, and she will be happy to connect you with any of the panelists.

Here we’ve assembled each of the resources referenced during the webinar and more, organized by program and paired with the relevant timestamps from the webinar recording.

Resources related to the clean energy tax credits available through the IRA (timestamped at 4:34-25:55 in the webinar recording):

- Energy Savings Hub (11:49, 16:19, 46:38)

- IRS Two-Pager on IRA Tax Credits for Individuals

- IRS One-Pager on Residential Clean Energy Credit (25D)

- U.S. Department of Treasury’s IRA Landing Page

- IRS Webpage on Elective Pay and Transferability (20:00)

- IRS One-Pager on IRA Direct Pay (20:55)

- Elective Pay and Transferability Frequently Asked Questions

- Pre-Filing Registration Tool User User Guide and Instructions (21:50)

- IRS Two-Pager on IRA Tax Credits for Organizations (22:10)

- Registration and Information for Office Hours with the IRS (24:20)

- IRA-Related Tax Guidance

- Rewiring America’s Savings Calculator for Home Electrification Appliance Upgrades

Resources related to USDA’s REAP (26:06-37:05 in webinar recording):

Resources related to AHFC rebate programs (37:07-49:55 in webinar recording):

There will be an AHFC energy rebate stand-alone site, but it is not quite ready for launch. REAP will be sure to promote when it is ready!

- Income Limit Information from 2024 Fiscal Year (39:10)

- AHFC Approved Energy Rater/Inspector List (41:38)

- Alaska Residential Energy Rebates Webpage and Updates Sign Up (47:17)

Thank you so much for your interest in this important topic and for supporting our Fall Energy Speaker Series! Watch the whole conversation here and then register to attend the next webinar in REAP’s 2024 Fall Energy Speaker Series: “Knowledge is Power: Clean Energy Education for Alaska’s Youth.”