| Electrification Upgrades | Maximum Amount of Rebate Provided | Average Market Price of Upgrade |

|---|---|---|

| Heat pump water heater | Not more than $1,750 | $1,500-$3,500 |

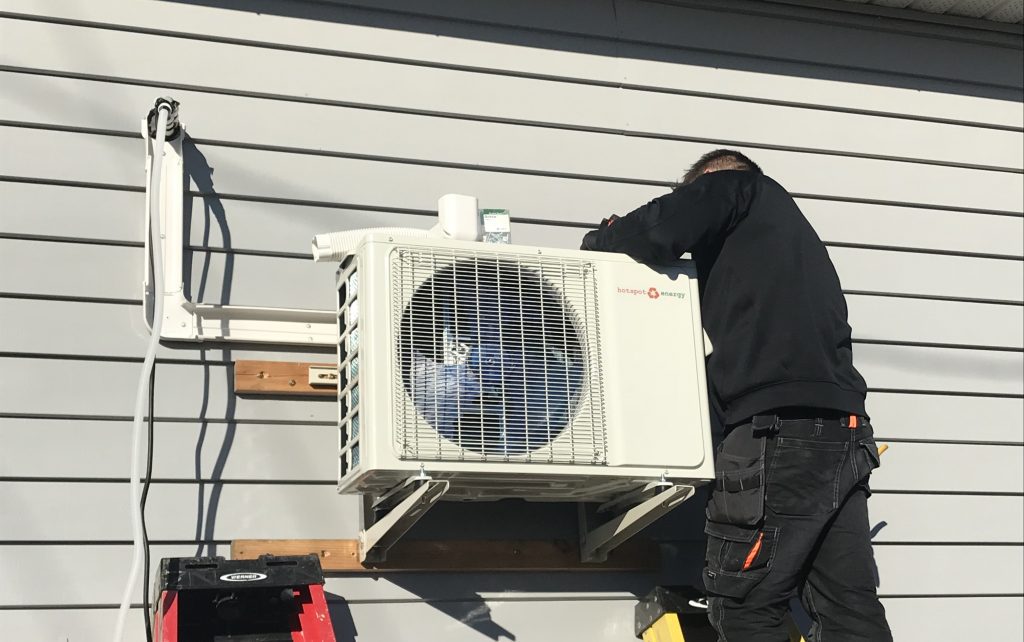

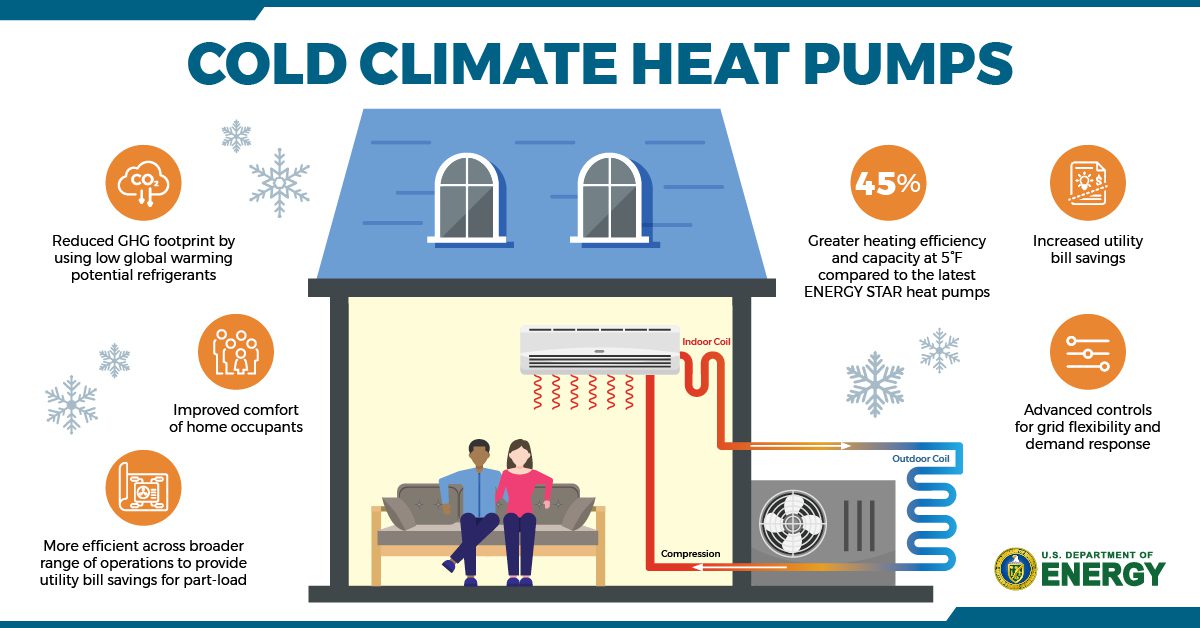

| Heat pump space heating or cooling | Not more than $8,000 | $4,000-$8000 |

| Electric stove, cooktop, range, or oven; or electric heat pump clothes dryer | Not more than $840 | $500-$3,000 |

| Electrical panel/breaker box upgrade | Not more than $4,000 | $1,300-$3,000 |

| Insulation, air sealing, ventilation | Not more than $1,600 | Dependent upon amount of insulation |

| Electric wiring | Not more than $2,500 | Dependent upon square footage and amps |

Inflation Reduction Act Home Energy Tax Breaks

The Inflation Reduction Act is the most ambitious energy and climate policy ever passed by Congress. It is estimated that its provisions will drive investment of $369 billion into clean energy and climate priorities. This investment comes in several different forms including tax credits, grants, and loans. However, you might be wondering how the average Alaskan can take advantage of these credits to save money and reduce the amount of energy you use. There are three main tax credits and two rebate programs Alaskans can leverage to save money and reduce energy consumption.

Rebates for Residential Energy Efficiency Improvements

The Inflation Reduction Act established two energy efficiency rebate programs that individuals can apply for: the HOME Rebates Program and the High-Efficiency Electric Home Rebate Program. These programs, run by the Department of Energy (DOE), will be administered by state energy offices. Timelines for program development and implementation are still being developed, so they are not available to homeowners yet. Alaska has been allocated $74,519,420 in total for both programs.

The High-Efficiency Electric Home Rebate Program

The High-Efficiency Electric Home Rebate program will be funded through state energy offices however, rebates will be administered- and income eligibility will be verified- at the point of sale. For households with annual income below 80 percent of an area’s median income, the household can receive rebates up to 100 percent of the project cost. For households with annual income between 80 percent to 150 percent of an area’s median income, the household can receive rebates up to 50 percent of the project cost. Total electrification rebates across all qualified electrification projects are capped at $14,000.

| Census Area | 80% of Median Annual Income | 80-150% Annual Income |

|---|---|---|

| Anchorage | $71,100 | $71,100-$133,300 |

| Mat-Su | $63,440 | $63,440-$118,950 |

| Fairbanks | $53,260 | $53,260-$99,860 |

| Kenai | $56,490 | $56,490-$105,910 |

| Juneau | $72,100 | $72,100-$135,189 |

The HOME Rebates Program

The HOME Rebates programs will administer grants to state energy offices. Once a state energy office applies for and receives the grant from DOE, it can provide rebates for whole-house energy saving retrofits begun on or after the date of enactment of the IRA and completed by Sept. 30, 2031. A rebate under HOME may not be combined with any other federal grant or rebate including the High-Efficiency Electric Home Rebate Program.

| Retrofit Energy Savings | Rebate Amounts for Single-Family Homes | Rebate Amounts for Single Family Homes Occupied by a Low-or-Moderate-Income Household |

|---|---|---|

| For retrofits that cut energy usage between 20 percent and 35 percent | 50% of the project cost; $2,000 maximum | 80% of the project cost; $4,000 maximum |

| For retrofits that cut energy usage by 35 percent or more | 50% of the project cost; $4,000 maximum | 80% of the project cost; $8,000 maximum |

| For retrofits that cut energy usage by not less than 15 percent | A payment rate per kilowatt hour saved, or kilowatt hour equivalent saved, equal to $2,000 for a 20 percent reduction of energy use for the average home in the state, or 50% of the project cost | A payment rate per kilowatt hour saved, or kilowatt hour equivalent saved, equal to $4,000 for a 20 percent reduction of energy use for the average home in the state, or 80% of the project cost |

Tax Credits for Residential Energy Efficiency Improvements (25C)

Starting in 2023 through 2032 homeowners can receive up to 30 percent of the project cost back through tax credits for making energy efficiency improvements to their home. This is capped at $1,200 per year but can be increased up to $3,200 if the improvements include heat pumps, heat pump water heaters, or biomass stoves. These credits can be used every year until 2032 and therefore it is recommended to take a strategic multi-year approach.

| Improvement Type | What is Eligible | Maximum Credit for Property Per Year |

|---|---|---|

| Insulation (air seal products also qualify) | Most recent International Energy Conservation Code as of two years prior | $1,200 |

| Home energy audits | Must be conducted by a certified home energy auditor (guidance to come from IRS) | $150 total |

| Doors | Energy Star | $250 per door, $500 across all doors |

| Heat pumps or biomass stoves | CEE highest tier below Advance Tier, Thermal efficiency of at least 75% | $2,000 total across heat pump water heaters, heat pumps, and biomass stoves. $1,200 annual limit does not apply |

| Natural gas, propane, or oil furnaces | CEE highest tier below Advance Tier | $600 per furnace |

| Heat pump water heaters | CEE highest tier below Advance Tier | $2,000 total across heat pump water heaters, heat pumps, and biomass stoves. $1,200 annual limit does not apply |

| Natural gas, propane, oil water heaters | CEE highest tier below Advance Tier | $600 per water heater |

| Electric panel (panelboard,sub-panelboard,branch circuit, or feeders) | Have a load capacity of at least 200 amps and are installed in connection with and enable the installation/use of any other types of property described under the earlier headings | $600 per property |

| Windows and Skylights | Energy Star Most Efficient | $600 across all windows and skylights |

What Improvements Should be Prioritized?

This will vary from property to property but it is highly recommended to conduct your own energy assessment and home energy audit (covered by the IRA) as it will give you the most accurate recommendations and estimated return on investment. For more in depth information on home energy tips and an IRA savings calculator follow the links below.

Tax Credits for Residential Energy Property (25D)

Starting in 2023 homeowners can receive up to 30 percent of the project cost through tax credits for rooftop solar and other residential clean energy systems installed on their homes.

Eligible Projects:

| Rooftop solar installation | In 2022, an average 6kW rooftop solar installation costs is $15,300, thus the average tax credit will be around $4,600. |

| Geothermal heat pumps | An average geothermal installation costs about $24,000, thus the average tax credit will be around $7,200. |

| Battery storage installation | An average battery storage installation costs about $16,000, thus the average tax credit will be around $4,800. |

| Fuel cells | |

| Small wind |

If an individual does not have sufficient tax liability to use up the entire credit amount during the year they install the property, they may carryforward any remaining credit one year. Additionally, individuals may see reduced pricing from community solar or solar leasing options, where the commercial entity takes the business credit for the property, rather than the individual.

Rooftop solar and other residential distributed energy systems are extremely beneficial when other load increasing appliances are added to homes such as heat pumps and electric vehicles.

25D also includes a 30 percent uncapped tax credit for an electrical panel upgrade, but only if it’s upgraded in conjunction with rooftop solar.

Tax Credits for New and Used Electric Vehicles (30D & 25E)

Starting in 2023 homeowners can receive tax credits of $2,500-$7,500 (dependent on battery size) for a new electric vehicle or plug-in hybrid and up to $4,000 for a used electric vehicle or plug-in hybrid.

The tax credit applies to electric vehicles with a maximum MSRP of $55,000 and vans, SUVs, and pickup trucks with a maximum MSRP of $80,000. Starting in 2023, the credit will also be subject to geographic manufacturing requirements that may initially limit the list of eligible models.

Eligibility Requirements: New Vehicles

| Final assembly of the vehicle must take place in North America |

| Battery capacity of 7 kW hours or be a fuel cell vehicle |

| Modified adjusted gross income limits by filing status: $150,000 for single, $225,000 for head of household, $300,000 for married filing jointly |

| Certain battery component sourcing requirements |

To find your prospective vehicle’s final assembly location use this VIN look-up tool.

VIN DECODEREligibility Requirements: Used Vehicles

| Be a model two years old |

| Battery capacity of 7 kW hours or be a fuel cell vehicle |

| Be sold by a participating dealer |

Starting in 2024, car dealers may provide the option of a “dealer transfer.” In this case, car buyers can transfer their credit to their dealer at the point of sale, therefore the credit can be used to reduce the purchase price instead of the buyer claiming the credit at tax filing.